OPINION: Budget Transparency Affects Everyone

When doing a personal budget, one is tasked with working out money to spend on essentials to meet his/her basic human needs such as food, water and shelter. One has to think about allocating funds for family members; paying off debt such as clearing arrears for hire purchase goods and then there are unforeseen circumstances to budget for as well. It is quite a daunting task but necessary. The whole budgeting process requires time for thorough planning.

Take that concept and apply it to the national level. One may view national budget discussions as technical as it deals with information and data that seem overwhelming. One may say leave it to the government, to those making policies and to economists, leave it with people who deal with finances on a daily basis but budgeting concerns everyone. If you are interested in health, education, the environment or pensions, the most well- meaning public policy has little impact on poverty until it is matched with sufficient public resources to ensure its effective implementation.

Government budget decisions would then lead to; what taxes to levy, what services to provide, and how much debt to take on. It affects how equal a society is and the well-being of its citizens, including whether the most disadvantaged will have real opportunities for a better life. Therefore, it is critical that governments inform and engage the public on these vital decisions that impact our lives especially as the world deals with the COVID-19 pandemic. A pandemic that has seen governments launch massive spending measures to address and to control the spread of the virus.

The Executive Director of the International Budget Partnership Warren Krafchick wrote,

“Budgets will play a central role in government responses to this virus and its fallout. We strongly support aggressive government action and, like others, we believe leaders should pay special attention to the needs of those living in poverty, who are particularly vulnerable to COVID-19’s devastating health and economic impacts. To meet these unparalleled challenges, governments must rapidly shift priorities and realign tax and spending policies. The rush to act may tempt some leaders to forego informing and engaging the public on the steps they take. However, while the crisis demands swift and decisive action, it nevertheless requires honesty, transparency, engagement and, in the end, public trust.”

The Open Budget Survey (OBS) 2019 released in April 2020 showed a ratio of four out of five of the 117 governments assessed failed to reach the minimum threshold for adequate budget transparency and oversight. The survey finds even fewer provided opportunities for the public to participate in shaping budget policies or monitoring their implementation but there are signs of progress. Most governments lack the accountability systems and policies to make budgets fully open and accessible to the public. There were gaps in budget transparency throughout the budget cycle especially in changes made during the budget implementation phase.

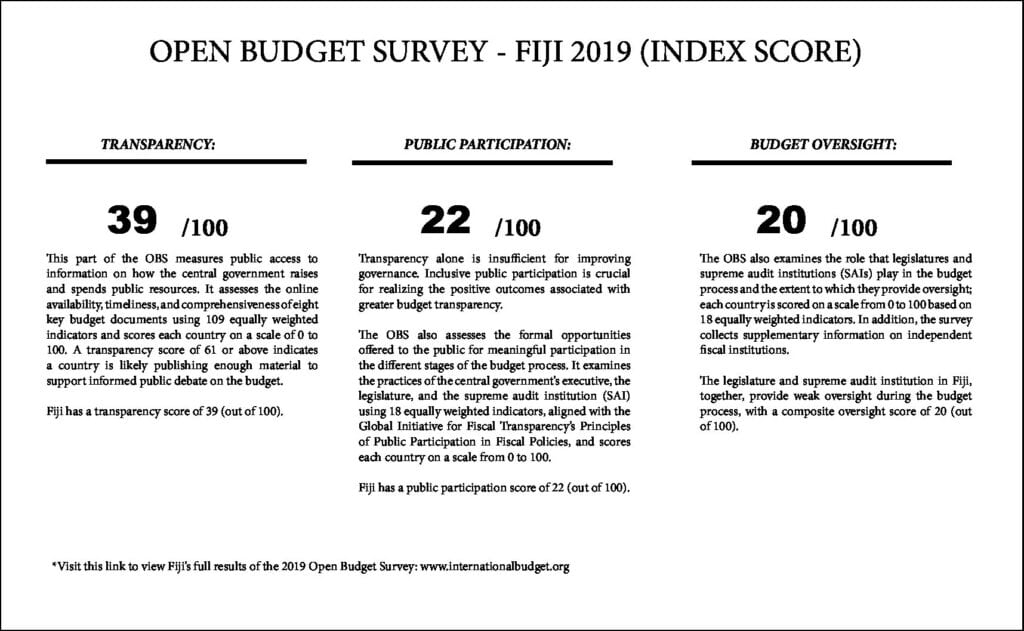

The OBS is the world’s only independent, comparative and fact-based research instrument that uses internationally accepted criteria to assess; public access to central government budget information, formal opportunities for the public to participate in the national budget process, and the role of budget oversight institutions such as the legislature and auditor in the budget process. The 2019 survey looked at documents published with events, activities or developments that took place through 31 December 2018. Each country’s draft questionnaire was reviewed by an anonymous independent expert as well as a representative of the Ministry of Economy. The survey measures three main components which are; Budget Transparency, Public Participation and Budget Oversight.

Budget Transparency, also known as the Open Budget Index measures public access to information on how the government raises and spends public resources. It assesses the online availability, timeliness and comprehensiveness of eight key budget documents using 109 equally weighted indicators and scores each country on a scale of 0 to 100. The key budget documents are the Pre Budget Statement, the Executive Budget Proposal, Enacted Budget, Citizens Budget, In Year Reports, Year End Report and Audit Report. In this round, a transparency score of 61 or more indicates that a country is likely publishing enough material to support informed public debate on the budget. Fiji has a score of 39 out of 100 ranking 72 out of the 117 countries. In the 2017 survey, the score was 41 out of 100. Fiji has increased the availability of budget information by publishing the audit report online. However it has decreased the availability of budget information by reducing the information in a supporting document to the Executive’s Budget Proposal (Budget Supplement) that previously showed details of projects by sector and was not available in the 2018/2019 budget proposal. Fiji should prioritize publishing in a timely manner the Pre-Budget Statement and all In-Year Reports online, produce and publish a Citizens’ Budget, Mid-Year Review and Year-End Report online; and include in the Executive’s Budget Proposal policies reflected in the budget and performance information.

Public Participation is where the OBS assesses the formal opportunities offered to the public for meaningful participation in the different stages of the budget process. It examines the practices of the central government’s executive, the legislature, and the supreme audit institution (SAI). It uses 18 equally weighted indicators, aligned with the Global Initiative for Fiscal Transparency’s Principles of Public Participation in Fiscal Policies, and scores each country on a scale from 0 to 100. Fiji scored 22 out of 100 in the latest survey while in 2017, it scored 15 out of 100. The Ministry of Economy has established pre-budget submissions during budget formulation and a public consultation during budget implementation. However to further strengthen public participation in the budget process, it should prioritize ensuring that any member of the public or civil society can engage with the government when monitoring budget implementation and actively engage with vulnerable and underrepresented communities, directly or through civil society organizations representing them. Fiji’s Parliament should prioritize allowing members of the public or civil society organizations to testify during its hearings on the budget proposal prior to its approval. The Office of the Auditor General has established mechanisms to assist the supreme audit institution in developing its audit program. It should prioritize establishing formal mechanisms for the public to contribute to relevant audit investigations.

The third component which is Budget Oversight examines the role that legislatures and supreme audit institutions (SAIs) play in the budget process and the extent in providing oversight. Each country is scored on a scale from 0 to 100 based on 18 equally weighted indicators. The survey finds the legislature and supreme audit institution in Fiji, both providing weak oversight during the budget process, with a composite oversight score of 20 out of 100. The Legislature scored 14 out of 100 while the Supreme Audit Institution which is the Auditor General’s office scored 34 out of 100. A few recommendations are as follows;

- Legislature should debate budget policy before the Executive’s Budget Proposal is tabled and approve recommendations for the upcoming budget.

- The Executive Budget Proposal should be submitted to legislators at least two months before the start of the budget year.

- Legislative committees should examine the Executive’s Budget Proposal and publish reports with their analysis online.

- A legislative committee should examine in-year budget implementation and publish reports with their findings online.

- To strengthen independence and improve audit oversight, the Office of the Auditor General should require legislative or judicial approval to appoint and remove the head of the supreme audit institution; and to ensure audit processes are reviewed by an independent agency.

The survey also collects supplementary information on independent fiscal institutions. The survey suggests the establishment of an independent fiscal institution (IFI) as a valuable independent and nonpartisan information provider to the Executive and/or the Legislature/Parliament during the budget process.

The Citizens’ Constitutional Forum (CCF) stresses the need for more transparency in public budgets and its processes. Budgets are powerful mechanisms that support the lives of people especially those that live below the poverty level and those that are marginalized in Fiji. Individuals and communities have the right to know how public monies are spent because they are tax payers whose daily lives are affected.

We should all be concerned with our Government budget decisions on taxes, services provisions and how much debt is taken on which affects equality and our well-being as citizens. Public budgets and human rights are linked and are recognized by international human rights mechanisms in their compliance with human rights obligations. For the realization of human rights to take place, the government must improve on Budget Transparency, Participation and Oversight.

When we have access to budget information with skills and opportunities to participate in the budget process, resulting engagement between government and citizens can lead to practical improvements in governance and service delivery.

Open Budgets, Transform Lives!

- See Open Budget Survey 2019 – https://www.internationalbudget.org/open-budget-survey/

- See Open Budget Survey 2019 : Fiji – https://www.internationalbudget.org/open-budget-survey/country-results/2019/fiji